Major pricing and reimbursement reform in South Korea, and the implications to manufacturers

On November 28th, the Ministry of Health & Welfare announced the Pharmaceutical Pricing System Improvement Plan, which will start in 2026 and touch nearly every aspect of the system, from rare disease access and innovative drug incentives to generic pricing and essential medicine supply.

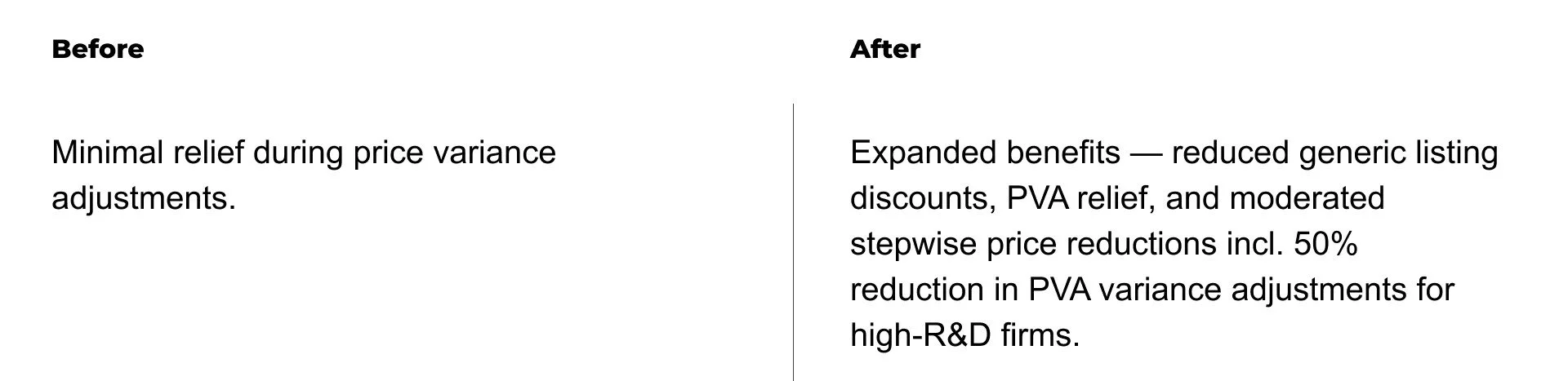

Key highlights of the changes before vs. after the reform:

Dual Pricing System Expansion

ICER Thresholds

Rare Disease Drug Access Timelines

Incentives for Innovative R&D

Essential Medicines Supply Framework

Stepwise Price Reduction (“Half-Price Rule”)

Timeline for Price Reductions

Periodic Systematic Reviews

Key implications for manufacturers:

Increased ability to avoid international reference pricing (IRP) spillover — especially under current pricing pressure due to MFN

The high list price with stricter net price confidentiality may lower the risk of “Korea passing,” meaning South Korea may become a more attractive early-launch market

The potentially more flexible ICER thresholds may allow a higher achievable price, particularly for oncology drugs that may not qualify for pharmacoeconomic evaluation exemption

The improved speed to market with the accelerated reimbursement timelines for rare disease treatments should improve the attractiveness of South Korean market for orphan drug launches

The expanded benefit on price protection and softer PVA penalties indicate a strong policy to incentivise local investment on innovations for manufacturers

However, with the new pricing floor dropping to 40% and quality-linked cuts reaching 80%, the launch and commercialisation of generics and biosimilars are likely to becoming more challenging in South Korea

Written by Ye Huang

Decisive Dialogue 4th December 2025